Upstox Originals

Inflation falls to a six-year low; what does this mean for the economy and markets?

8 min read | Updated on June 25, 2025, 16:46 IST

SUMMARY

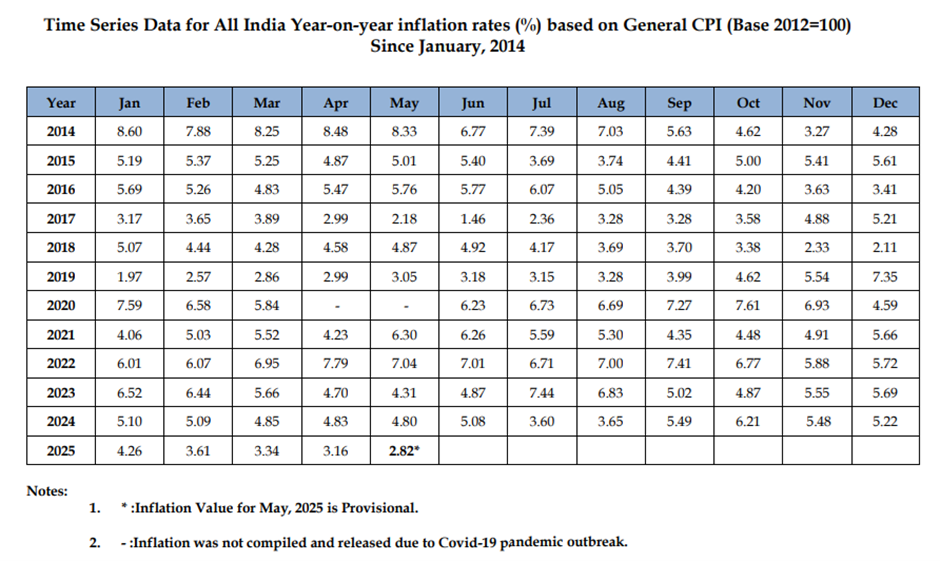

According to recent government data, retail inflation in India dropped to 2.82% in May 2025. This is the lowest annual rate since February 2019. For the last seven months, starting in November 2024, inflation has been on a continuous decline. This article explores how falling inflation affects daily life, the markets and the overall economy.

Retail inflation in India dropped to 2.82% in May 2025

The government just released inflation data for May, and there is some good news.

Amid global economic uncertainty, India’s retail inflation has just taken a breather. According to the Ministry of Statistics and Programme Implementation (MOSPI), retail inflation in India fell to 2.82% year-on-year (YoY) in May 2025. Interestingly, this is the lowest level reached in the past six years.

Source: Ministry of Statistics and Programme Implementation

The May 2025 inflation numbers indicate a decline of 34 basis points from 3.16% in April 2025 and the lowest YoY inflation recorded since February 2019.

Source: Ministry of Statistics and Programme Implementation

This marks the fourth consecutive month that inflation has remained below the Reserve Bank of India's medium-term target of 4%. According to an SBI Research report, India's retail inflation may further decline to 2% or lower by July 2025. That brings us to the point: Is the cooling down of inflation good or bad? We will come to it. But right now, the key question is:

Why was there such a sharp drop in inflation?

Well, there are many reasons for retail inflation hitting a six-year low in India.

Decline in food prices

The biggest reason for the drop in inflation is the sharp fall in food inflation. The Consumer Food Price Index (CFPI), which is an indicator of food inflation, considerably fell from 1.78% in April 2025 to 0.99% in May 2025. This helped pull down the overall inflation rate.

Source: Ministry of Statistics and Programme Implementation

There were similar inflation declines in the rural and urban areas in May 2025. Food inflation in the rural sector fell to 0.95% and 0.96% in the urban sector.

Roughly speaking, food and beverages make up half of India’s Consumer Price Index (CPI) basket. So, when food prices move, they significantly impact inflation. Coming to numbers, food inflation in May dropped considerably, to 1.5% from 2.1% in April. This is the lowest in 73 months.

This was mainly due to a continued decline in food prices, especially of staples. These items make up a large part of the average Indian household’s diet, so when their prices go down, it brings immediate relief.

Digging deeper, here’s how prices across individual key food categories fared:

| Food categories | Decline in prices in May (YOY) |

|---|---|

| Vegetables | 13.7% |

| Potato | 20.3% |

| Onion | 10.7% |

| Tomato | 26.2% |

| Pulses | 8.2% |

| Cereals | 4.8% |

| Spices | 2.8% |

Stability of fuel prices

Prices of fuel, especially petrol and diesel, have been relatively stable in the past few months.

Moreover, the sharp slump in global crude oil prices also worked in India’s favour. It helped reduce inflationary pressures in two ways. First, by directly reducing the prices of petroleum products in the consumption basket. And second, by indirectly lowering input costs across the manufacturing and logistics sectors.

That’s not all. Declining global crude oil prices also helped India lower its energy import bill. Given that India relies on imports for over 85% of its total crude oil requirements, this is a big deal!

Just so you know, a drop in oil prices reduces India’s current account deficit by 30 bps for every $10 decrease in oil prices.

In the time to come, experts believe that crude oil and Liquefied Natural Gas (LNG) prices will continue to fall globally, and with that, India is likely to save an estimated ₹1.8 lakh crore on its energy import bill in FY 2025-26. While this may seem like good news, let’s not forget the impact of global instability and ongoing conflicts, which can be a threat to crude oil prices.

Strong performance of the Indian rupee

The Indian rupee has shown a strong performance in comparison to other major currencies in the past few months (except US dollar). A steady currency has helped India control inflation by reducing the cost of imports, especially oil and machinery costs.

Let’s break it down one by one.

Is low inflation really a good thing?

This is a crucial question, simply because inflation directly impacts your cost of living. It impacts you, your finances, businesses, capital markets and the overall economy.

We all know that high inflation eats into your savings, and low inflation makes it easier to manage your expenses. And why not? When inflation is low, your money stretches a bit further—your grocery bills may be a little lighter, and prices of everyday essentials aren’t rising as quickly.

Good news, right? Well, not exactly!

There’s a catch!

Extremely low inflation is also not ideal. It signals weak demand, which is bad for growth.

And in extreme cases, when the inflation rate turns negative, it can also lead to the risk of the economy slipping into deflation, which refers to a decline in the prices of goods and services. Deflation can reduce consumer spending, as people wait for prices to fall further. This creates a vicious cycle of decreased demand and can lead to economic stagnation.

But here’s the thing — the government is countering this with impactful interventions. The Reserve Bank of India (RBI) has made aggressive interest rate adjustments in the past few months to inject more liquidity into the system. With more supply of money, we can expect the demand to rise.

Earlier this year, in February and April, the RBI had cut the repo rate by 25 basis points each, bringing the rates down to 6%. And again in June, the RBI slashed the repo rate by 50 basis points to 5.5%. RBI’s three consecutive repo rate cuts this year have helped support economic growth.

While we zoomed in and saw some negatives, let's also zoom out a bit and look at the positives.

Benefits of low inflation on the economy

Builds positive consumer sentiment

Low inflation means that the same amount of money can buy more goods and services. This increases the real income of consumers, which in turn improves their purchasing power. This leads to an increase in consumer spending. For context, According to the CMS Consumption Report, the average monthly spending in FY25 increased by 72% on consumer durables, 12% on multi-brand outlets and 4% on FMCG.

Encourages investment

Low inflation gives the RBI more flexibility to lower interest rates to stimulate economic activity. With low interest rates and affordable borrowing, people and businesses are likely to invest more, which in turn drives economic growth.

Brings economic stability

Sustained low inflation supports positive economic expansion and brings more stability. It eliminates the uncertainty of rapidly rising or falling prices, which boosts confidence among consumers and businesses.

How low inflation impacts the stock market

Lower inflation typically creates a favourable environment for businesses. With costs being low, it's easy for companies to maintain or increase profit margins and show strong revenue. This stability often increases investor confidence and the demand for shares grows. The result? It builds bullish sentiments among investors and share prices go up.

There is another interesting point here.

Lower inflation also makes dividend-paying stocks more attractive. Because of a simple reason — the more modest the rate of inflation, the higher will be the real interest earned per payment.

Let us explain…

Let’s say if the inflation is 4% and the dividend is 6%, then the real interest earned per payment will be only 2%.

But now, let’s say if the inflation is 2% and the dividend is the same 6%, then the real interest earned per payment will be 4%.

Another category of stocks that typically see an increase in demand during a low-inflation period is high-risk category stocks. The reason is — low inflation indicates a stable and predictable economic environment, which boosts investor confidence and willingness to take on more risk in the desire for high-growth stocks.

Let’s also talk about the sectors that are likely to benefit the most from a lower inflationary cycle.

FMCG and retail sector stands to benefit because of the increased disposable income and spending among consumers. Automobile and housing sectors that are largely dependent on consumer financing can see a boost as low interest rates are likely to drive sales.

Banking and financial services sector may also gain due to increased borrowing and financial activities among consumers, driven by stable rates and higher spending.

Before you go

While the overall impact of cooling inflation sounds promising for the stock market, you must also take into account the long-term view of the market before making investment decisions. Also, the drop in inflation is undoubtedly a welcome relief for individuals, businesses, markets and the economy and presents a picture of economic stability.

But we also need to understand that global factors like climate change, trade tensions and geopolitical instability can cloud the bigger picture.

For now, we can only hope that the government will continue to bring effective monetary and fiscal policies to manage inflation and economic stability.

About The Author